Could you release more money with your lifetime mortgage?

Our Lifetime Mortgages give you the option to take less than the maximum amount you're eligible for when you take out the initial loan. If you’ve chosen to take less, you may be able to borrow more as and when you need it.

The difference between the initial cash sum you've taken and the maximum amount you could take is called your Drawdown Facility. If you have a Drawdown Facility available, it’ll be shown on your annual statement and you could apply by following the instructions below.

Any additional borrowing will be secured against your home and will be based on the terms available from us at the time you apply.

If you have no Drawdown facility available and the value of your home has increased sufficiently since you took out your Lifetime Mortgage you may be able to release more equity through a Further Advance.

There is no Drawdown Facility on our Payment Term Lifetime Mortgage.

When you’re taking more money from your Drawdown Facility there’s a few things to consider, and you may want to go back to your financial adviser for guidance.

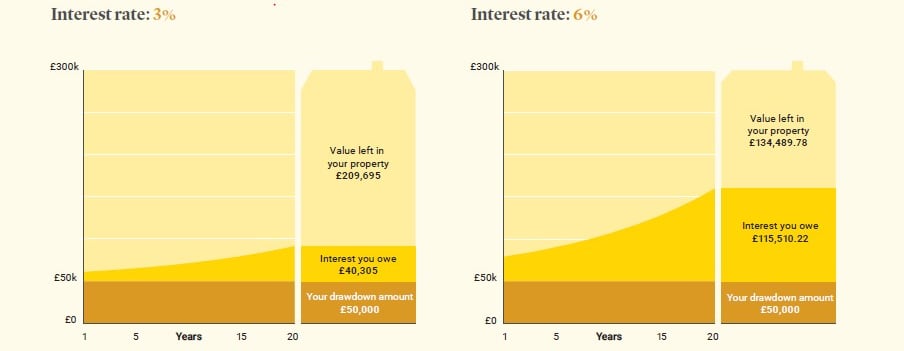

- A different interest rate may apply to each drawdown amount you take and may be higher or lower than the interest rate on your initial loan. The rate will depend on the interest rates available for your lifetime mortgage, on the date you apply for the drawdown. We’ll confirm the interest rate in the Offer of Loan we send you for the drawdown.

- You should only release what you need at the time from your Drawdown Facility. As you'll pay compound interest from the day we pay the money to you.

- Your Drawdown Facility will reduce by the amount you drawdown so there will be less available for your future needs.

- The minimum amount you can drawdown online is £1,000. If you have less than £1,000 remaining in your Drawdown Facility you will need to call us on 03330 048444. Monday to Friday 8.30am to 5.30pm. We may record and monitor calls.

If you apply online for a drawdown, we’ll send the Offer of Loan to you through DocuSign (our secure email portal).

If your lifetime mortgage is in joint names, then you'll need to complete the drawdown request form with the joint account holder.

To complete the drawdown request please have the following information ready:

- Loan Account Number: You can find this on your initial Offer of Loan document or annual statement

- Your contact details: Home address, telephone number and email address. If you’re applying online then your email address is essential for us to process the drawdown.

- Purpose of drawdown: Information on your intended purpose for the drawdown you request, with details of how much you intend to use for each purpose. For example, Home improvements £5,000 (sofa £2,000, boiler £3,000)

- Bank account details: Where you would like the drawdown paid.

The simplest way to request a drawdown is online. You can apply for a drawdown in 5 simple steps

Step 1:- Complete the online application form. This will take about ten minutes to complete, you’ll need to share your email address and have the required information to complete the application. If this is a joint account you need to complete it together.

Step 2:- When you’ve submitted the drawdown application, we’ll review the information you’ve provided. If everything is clear and acceptable to us, we'll send you an Offer of Loan for the drawdown. If we need further details we’ll call you back within two working days to discuss your application.

Step 3: - When you receive the Offer of Loan, please check all the details, sign the document and return to us. If this is a joint account you’ll both need to sign.

| If you have a joint lifetime mortgage account, one account holder will need to sign and return the offer of loan before the other will receive their email to do so. Each account holder must use a different electronic signature. If you have one email address, emails for each person will be sent to the same address. |

You will be able to sign your Offer of Loan online via a secure platform. Additional guidance and support can be found on How do I sign a DocuSign.

Step 4:- When we receive your signed Offer of Loan we’ll send you a confirmation letter and pay the drawdown amount into your bank account.

Step 5:- You’ll have access to the money you asked for and we’ll keep you updated through your annual statement of any drawdowns taken and your remaining Drawdown Facility.

You can also apply for a drawdown by calling us on 03330 048444. Monday to Friday 8:30am to 5:30pm. We may record and monitor calls.